it's probably some are peak like a weekend and some are off-peak, for example, I booked a trip to see family during thanksgiving and that Friday night was higher points than the other nights for some reason.OK - if I can see availability at the "rates from 20,000 per night" - then I look at the points calendar to determine the nightly cost

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

I love credit cards so much! v5.0 - 2022 (see first page for add'l details)

- Thread starter SouthFayetteFan

- Start date

- Status

- Not open for further replies.

is it all-inclusive? I see the 50% of the room charge based on 2 people rate I just plugged in random dates for points and it didn't do the increase. I saw this when I was thinking about Ziva for next year I emailed them they said kids under 12 were included (for Ziva) i wonder if the same thing applies to you got costa Rica in my brain tooI would email the hotel directly so there are no surprises at check in. There are complaints on TripAdvisor of unexpected charges when booking third party. Los Altos is an SLH and not an actual Hyatt.

I was considering this place until I saw the extra people charges, so I certainly hope I’m wrong.

wanderlust7

DIS Veteran

- Joined

- Mar 10, 2015

is it all-inclusive? I see the 50% of the room charge based on 2 people rate I just plugged in random dates for points and it didn't do the increase. I saw this when I was thinking about Ziva for next year I emailed them they said kids under 12 were included (for Ziva) i wonder if the same thing applies to you got costa Rica in my brain tooall I see is a phone number no email.

Los Altos Resort is not all inclusive. On their website it’s very clear that base rates are double occupancy. There is an email and toll free number on there.

platamama

DIS Veteran

- Joined

- Mar 6, 2009

Good job! Here's an extra tip: you can get still get a SW CP if you have a partner who uses your SW card support link to get their own SW card. I did that with DH's SW 100K SUB card (I applied for a SW biz using his link) and he has a CP (with me as the companion) until end of 2023. You might even be able to get one of your four RT tickets over Thanksgiving refunded if that works to your advantage, up to you to decide.Earlier this year Chase had an offer with their SWA card for 100,000 points with a $10K spend. Used those points and some already on the account to get four round trip tickets to WDW this Thanksgiving week. Then I used my BoA premium rewards cards to pat for the taxes and Early Bird option for both trips. BotTom line was it cost me $4.80 for the four tickets, I love playing the game.

I've booked tickets to Costa Rica and back over Christmas for the two of us (OOP value of $2622) for $162 in taxes and fees that's completely refundable if we change our minds about the trip.

well, I've noticed if I plug in some ages for other places that charge for a 3rd the point value goes up I wonder why it didn't on this. I did see it for cash just not on points. What's their email? I'm now curious. edit I Found it I'm going to email them.Los Altos Resort is not all inclusive. On their website it’s very clear that base rates are double occupancy. There is an email and toll free number on there.

CaptainAmerica

DIS Veteran

- Joined

- Oct 12, 2018

Can you guys check my strategy here? I'm working SUBs for both AMEX Plat and Gold at the same time. My plan is to open a Green card six months from now, and immediately bang out that SUB. Six months after that, I cancel both the Plat and Gold when the AFs hit. My understanding is that I can hang onto my MRs by virtue of still having the Green open and having completed 12 full months with each of the first two. Then, when the second Green AF is slated to post, I start hitting them up for retention or targeted upgrade offers. I believe upgrades are exempt from the "once per lifetime" bonus restriction.

Judique

Dis Veteran, Beach Lover at BWV, BCV, HHI, VB

- Joined

- Aug 1, 2003

Can you guys check my strategy here? I'm working SUBs for both AMEX Plat and Gold at the same time. My plan is to open a Green card six months from now, and immediately bang out that SUB. Six months after that, I cancel both the Plat and Gold when the AFs hit. My understanding is that I can hang onto my MRs by virtue of still having the Green open and having completed 12 full months with each of the first two. Then, when the second Green AF is slated to post, I start hitting them up for retention or targeted upgrade offers. I believe upgrades are exempt from the "once per lifetime" bonus restriction.

Yes, so long as you have an existing MR card, your MR's stay. I am lucky in that I have an old Amex from the late 90ties that's a no annual fee credit card - the Amex Optima.

Good luck with Amex. They give you what they want to give you.

Some people have had luck with getting offers after getting the bonus already.

Alexle2007

DIS Veteran

- Joined

- Apr 15, 2013

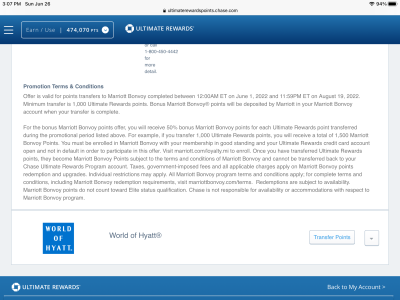

You‘ve got it. I would compare the cash price with Marriott reward point price to see which is the better option, even with the 50% bonus.I am going on a trip to the Seattle area in August and I am using Chase points to pay for hotels. I saw there is a 50% bonus to transfer points to Marriott which is basically half off if I transfer just to pay for hotels? Or am I mistaken?

I hope you and your family are doing well. I was just drinking of your mom the other day when a picture of Sheraton lounge at Sand Key popped up. That was where I met your mom.

CaptainAmerica

DIS Veteran

- Joined

- Oct 12, 2018

Yeah that's why I jumped all over 150K and 90K targeted offers at the same time. Normally I'd never sign up for $10K minimum spend all at once.Good luck with Amex. They give you what they want to give you.

LilSweetPeaPhoto

DIS Veteran

- Joined

- Feb 12, 2008

Ahhhhhhh! Tomorrow we're off to Cancun to use the 50k FNC. Looks like any storms will hit after we leave, so YAY! I'm still holding onto the Delta flight in case something happens w/ the Spirit flight, but the load shows 26 open seats, so we should be able to both get on (I mean he will for sure, LOL).

My son's Surpass card just showed up. So I need to meet the $1k on that (I have 6 mos, LOL) and then I'll likely decide what I'm going to do next. Am I finally going to try the MDD? AHHH, LOL.

My son's Surpass card just showed up. So I need to meet the $1k on that (I have 6 mos, LOL) and then I'll likely decide what I'm going to do next. Am I finally going to try the MDD? AHHH, LOL.

Mine always show up in my IHG account. I think they are 40k certs. I'm not sure how soon they show up though, LOL. I never pay attention.Question about IHG card. This is my first year with the card. When does the free night certificate appear (where do I look for it) and what’s the value of it? I need to add a day on to the first and lady day of a trip I have planned for next year and hoping I can use it!

It was the wording that said you can not currently have an IHG personal card. In the past you could have both cards and get the SUB as long as it's been 24 mos. I got Premier #1 in 10/2018 closed 8/21. I got the Traveler 1/21. So I both cards. Then I got Premier #2 8/21 and again got the SUB. But now how it's worded it seems you can't have both personal. GRRR!Sorry, this was a little hard to follow the dates of your plans, but you plan to churn an IHG personal card every 24ish months, right? I read the terms to mean that you cannot have received a new Cardmember bonus on any IHG personal card in the last 24 months. Is that your understanding or am I interpreting it incorrectly?

In my experience, the FNC has posted the day after the AF. Will it get clawed back if you cancel after the FNC gets posted?

No suggestions on the cards, but my BF is a pilot. He always recommends people don't get a degree in Aviation so they have a backup plan when the industry goes through it's ups and downs. Plus he said colleges charge WAY more for flight hours, etc. After seeing what he makes, I've told both my kids to become pilots, LOL. But I'm sure as you know, it costs SOOOOO much! Also he really feels my 13yo wouldn't be able to have a "full career". He really thinks planes will be pilot-less in my son's lifetime/career. But again we never know.I haven't been here in so long--you all have been plugging right along! I gave up on ever figuring out how to take full advantage of credit cards--I just don't think I have it in me--but I have gotten some excellent advice here over the years and due to you all I think I currently am at least using the cards that are right for me.

I'm back because I need a new card.I am not going to follow the usual format because I have not gotten any new cards in well over two years. I currently have:

Chase Marriott Bonvoy

AmEx Blue Sapphire Preffered

I also have one or two store credit cards (J Jill and I think one other) that I haven't used in years and probably just need to close. I don't even have a physical card for these anymore.

I have excellent credit and I pay my balances in full every month.

My current needs are a little different. I have a daughter going off to college in August and she is going a somewhat non-traditional route. She wants to be a pilot, and she plans to attend community college and get her Associate of Science degree while she gets her pilot's license, and then transfer to a 4-year university to finish up her degree after that.

The catch is that she wants to do all of this waaaaay across the country from home. It would be much cheaper if she could live at home, but....

Anyway, that's not what this board is about. She's going, and it's going to be expensive. Between tuition for both schools, renting her an apartment (no dorms), furnishing and equipping the apartment, getting some necessary repairs done to her vehicle before she dries it a could thousand miles across the country, etc., I'll be spending a lot of money over the next few months.

While we have plenty of money "put away," we never earmarked anything as specifically for our children's education, and now is kind of a bad time to be withdrawing funds from any of our accounts. We also currently have a large discrepancy between our income and our expenses; after paying off our house and me going to full time work at a new job, we have a lot more money coming in than going out. It seems more financially sound to leave our investments intact and just pay "out of pocket" for our daughter's expenses.

Here's what I'm thinking...my income will NOT cover all the expenses I'm going to accrue over the next few months. I teach at a university and my summer session ends this week, so I won't even have any more paychecks coming in until mid-August, but easily within a few months I could pay off whatever balance accumulates. So for the first time ever I'm considering carrying a balance. Very temporarily!!!

Any advice on a card that would work well for me? I don't mind an annual fee if the rewards are good, and I don't mind a high initial spend because that will not be a problem at all. My biggest issue is that I will be carrying a balance probably through the end of the year. After that, there is no need for that to ever happen again.

Are there any cards with good rewards and little or no interest charged for the first 4-6 months? I think I could pay it off by the end of October if necessary. Honestly I may be able to pay it off much sooner, I just know that there are likely to be a lot of unanticipated expenses that I am not currently considering and I don't want to be caught in a bind and end up having to transfer money out of my investment accounts after all.

Any suggestions will be appreciated, and if anyone has a referral link let me know and I'll use it.

afan

Honorary Bus Driver

- Joined

- Dec 30, 2014

He really thinks planes will be pilot-less in my son's lifetime/career. But again we never know

They can't get the cars to work right. Even as a 13 yo, I can't see planes not still needing at least a person that could fly the plane in the cockpit. Not the same as a subway system on tracks, run by a computer with far less variables than either cars or planes can encounter.

I also can't imagine the current fleets would be easily (in the budget to make it worth it) to convert them to not need a pilot.

From what I know of a local program, unless he's aware of all the programa, going the college route can be good. Aside from joining the military, you've still got to have a way to learn more than just a single engine etc.

I think it's awesome she wants to be a pilot, and I'm sure she has, but do look into scholarships and stuff. I know the program here, which I think is for hs kids to get thrm interested and on the right path to flying, is trying to diversify the profession so I would imagine there could be money out there for her.

afan

Honorary Bus Driver

- Joined

- Dec 30, 2014

If DH applied for a chase card today and we asked to have it expedited, what do you think the chances we could get it by Thursday would be?

Which card? Some are easier than others. A non cobranded card is easier to get expedited.

Probably an ink. Or maybe a sapphire and then double dip.Which card? Some are easier than others. A non cobranded card is easier to get expedited.

havaneselover

Dreaming about a Disney cruise

- Joined

- Nov 9, 2009

So I've got to cancel my Biz Platinum and my Vanilla Platinum in July. Biz Platinum is only a year old but I was told yesterday there aren't any retention offers available. I got a retention offer last year on the Vanilla Platinum. Unfortunately my 20,000 MRs never posted for adding pay over time to the Vanilla Platinum. Now I'm just trying to figure out how to get the most out of these before I cancel them. I just renewed my Clear. I'm thinking:

Vanilla: go to Saks and buy a gift card, try to use $200 FHR offer, adjust streaming, change Walmart+ to CS Platinum (which may get canceled next )

)

Biz Platinum: Use Dell credit

I guess I also need to figure out the airline credits but honestly buying SW tickets seems like such a pain. I'm struggling to keep track of travel funds (SW doesn't make it easy). Maybe if I didn't have a lot of points this would be easier.

Vanilla: go to Saks and buy a gift card, try to use $200 FHR offer, adjust streaming, change Walmart+ to CS Platinum (which may get canceled next

)

) Biz Platinum: Use Dell credit

I guess I also need to figure out the airline credits but honestly buying SW tickets seems like such a pain. I'm struggling to keep track of travel funds (SW doesn't make it easy). Maybe if I didn't have a lot of points this would be easier.

havaneselover

Dreaming about a Disney cruise

- Joined

- Nov 9, 2009

My Ink was approved on a Sunday and I think I had it Tuesday. Maybe Wednesday.Probably an ink. Or maybe a sapphire and then double dip.

palhockeymomof2

DIS Veteran

- Joined

- Nov 14, 2001

I’ve requested an ink card to be expedited on a Monday and it was delivered by UPS on WednesdayProbably an ink. Or maybe a sapphire and then double dip.

The CSR is automatically expedited

Alexle2007

DIS Veteran

- Joined

- Apr 15, 2013

Remember to use the $10 phone credit on the Biz Plat also.So I've got to cancel my Biz Platinum and my Vanilla Platinum in July. Biz Platinum is only a year old but I was told yesterday there aren't any retention offers available. I got a retention offer last year on the Vanilla Platinum. Unfortunately my 20,000 MRs never posted for adding pay over time to the Vanilla Platinum. Now I'm just trying to figure out how to get the most out of these before I cancel them. I just renewed my Clear. I'm thinking:

Vanilla: go to Saks and buy a gift card, try to use $200 FHR offer, adjust streaming, change Walmart+ to CS Platinum (which may get canceled next)

Biz Platinum: Use Dell credit

I guess I also need to figure out the airline credits but honestly buying SW tickets seems like such a pain. I'm struggling to keep track of travel funds (SW doesn't make it easy). Maybe if I didn't have a lot of points this would be easier.

I am curious why it is struggle to keep up with the SW credits? I just logon to the RR and can see all of the funds and just use whatever is expiring first when I need to purchase a ticket.

*WDW*Groupie*

DIS Veteran

- Joined

- Oct 2, 2006

For the $200.00 hotel credit try using the RHT. I used the airline credit to put money in my United travel account before I closed the biz plat; received the credit in January (not sure if this loophole has been closed).So I've got to cancel my Biz Platinum and my Vanilla Platinum in July. Biz Platinum is only a year old but I was told yesterday there aren't any retention offers available. I got a retention offer last year on the Vanilla Platinum. Unfortunately my 20,000 MRs never posted for adding pay over time to the Vanilla Platinum. Now I'm just trying to figure out how to get the most out of these before I cancel them. I just renewed my Clear. I'm thinking:

Vanilla: go to Saks and buy a gift card, try to use $200 FHR offer, adjust streaming, change Walmart+ to CS Platinum (which may get canceled next)

Biz Platinum: Use Dell credit

I guess I also need to figure out the airline credits but honestly buying SW tickets seems like such a pain. I'm struggling to keep track of travel funds (SW doesn't make it easy). Maybe if I didn't have a lot of points this would be easier.

- Status

- Not open for further replies.

GET A DISNEY VACATION QUOTE

Dreams Unlimited Travel is committed to providing you with the very best vacation planning experience possible. Our Vacation Planners are experts and will share their honest advice to help you have a magical vacation.

Let us help you with your next Disney Vacation!

Dreams Unlimited Travel is committed to providing you with the very best vacation planning experience possible. Our Vacation Planners are experts and will share their honest advice to help you have a magical vacation.

Let us help you with your next Disney Vacation!

New DISboards Threads

- Replies

- 3

- Views

- 67