_auroraborealis_

I like marshmallows. And adult beverages.

- Joined

- Oct 18, 2015

Wow...Disney wants to pay less money to the government, not surprised. LOL

Bill

BillWow...Disney wants to pay less money to the government, not surprised. LOL

These costs are simply going to be passed onto resort guests, so ultimately it's not really Disney who is going to be paying for them.

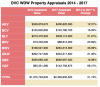

It seems ridiculous in some cases that assessments are being increased over 200%.

Florida has no personal income tax. Property tax is a huge source of their revenues.

True about the personal income tax. But we do get sales taxed on groceries, impact taxes for bringing a car into the state and a good number of other things, that along with the very, very high property taxes, make up for that difference IMO. I've been here 20 years.

Florida's property taxes are mid-range when compared to the entire US. Once you factor in no income tax, it's a pretty low-tax state to live in.

I'd love to see the chart you quoted that from stating FL property taxes are "mid-range". And property taxes vary by WHERE one lives in FL. And I happen to live where they are not "mid-range". Sure, you can come on down and buy some property out in the sticks in Fl, and have pretty good property taxes. You don't say where you live.

ou cannot compare states as there are too many factors involved. People from the Eastern seaboard and many other states moved to Florida for a reason and prices in Florida are increasing with the demand for more expensive properties. But a over 200% increase in property evaluation is ridiculous.

I'd love to see the chart you quoted that from stating FL property taxes are "mid-range". And property taxes vary by WHERE one lives in FL. And I happen to live where they are not "mid-range". Sure, you can come on down and buy some property out in the sticks in Fl, and have pretty good property taxes. You don't say where you live.

Which assessments are you referring to? The official data from the Orange County Property Appraiser doesn't show any DVC property, once built out, having such a large increase in its assessment.It seems ridiculous in some cases that assessments are being increased over 200%.

Well, I didn't mean to be offensive, I actually just kind of find this stuff interesting. In addition to the link above provided by another poster, I really like this one:

Thanks! That was kind. And I did some digging and saw that in many respects, FL does have much lower taxes than say, IL and the Northeast for example. We are self-employed and taxes absolutely eat our lunch. And a lot of our breakfast too!

Thanks! That was kind. And I did some digging and saw that in many respects, FL does have much lower taxes than say, IL and the Northeast for example. We are self-employed and taxes absolutely eat our lunch. And a lot of our breakfast too! Please update us if you get any further info. This could make or break future sales.