Rob Huff

Mouseketeer

- Joined

- Sep 22, 2016

Wait, what? I'm having heart palpitations over here.The worst one I saw was a dentist and his wife. He made great money - and they were still overspending by over $17,000 per month!!!!

Wait, what? I'm having heart palpitations over here.The worst one I saw was a dentist and his wife. He made great money - and they were still overspending by over $17,000 per month!!!!

I know! That must take some serious effort!Wait, what? I'm having heart palpitations over here.

The worst one I saw was a dentist and his wife. He made great money - and they were still overspending by over $17,000 per month!!!!

Ok I'm interested. Not sure if i Can achieve any of this, but I'm off to read some recommended blog posts..... I need to learn.

Ok I'm interested. Not sure if i Can achieve any of this, but I'm off to read some recommended blog posts..... I need to learn.

thank you! I started reading,and already learning some things I need to do to get this rolling (this topic has always intimidated me before)That's exactly how most of us started. Some are only embracing FI or RE, some both, others not really aiming for either but it's helping them on their savings journey. No right or wrong way.

We're here if you have any questions or want a second set of eyes on ideas or scenarios.

Try to take it a bit at a time. It's a big subject and can feel overwhelming at the start but when broken down, the individual steps are not complicated.thank you! I started reading,and already learning some things I need to do to get this rolling (this topic has always intimidated me before)

Please don't be intimidated! You want to get started, that's the most important thing.

I mentioned earlier, when I graduated college and had my first "real" job, I thought 401ks were a scam. They just seemed too good to be true! At the time, I was 21 and loaded up with student loan debt. Still, I contributed 1.5% and got the company match. Money was tight back then!

I worked 10 years, then became a SAHM. Obviously, I stopped the paycheck contributions, but rolled my pension over when I left the company. We also put $$ in my IRA a couple times for tax purposes. Bottom line is, now, 35 years later, my account has over $350,000. My point being, I started small, and didn't really know what I was doing. By adding additional, small amounts, and LEAVING IT ALONE, I now have a nice chunk of change. We have a lot more in DH's accounts, but he's been working all along.

Feel free to report even small progress, ask any questions, etc. We're pretty non-judgemental here.

The first $100k is a big deal for sure - regardless of when you hit it.My first boss was my personal finance mentor. I never made a lot of money and have worked part time for the majority of my working years. He told me it takes forever to get that first 100k saved up but once you do it starts rolling. He was right. It took me 26 years to save 100k in my 401k(remember part time, don't make a lot of $$). My 2nd 100k only took 5 years to achieve. I'm on a roll...

The first $100k is a big deal for sure - regardless of when you hit it.

When I was 22 making somewhere around $30k a year I set a goal to have $100k saved for retirement by 30. I did the math and realized that if you saved 100k by 30 you were basically set to have enough for a basic retirement by the time you turned 70 (even if you didn't save another dollar). I tried to convince my wife that we could just live in a van for a year and save everything we earned... she wasn't too keen on that, so we did it the old fashioned way. But we still hit the goal!!

Anybody young who has ever asked me for advice, I've said 100k by 30!! LOL!

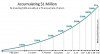

I love this chart as it shows how things escalate quickly:My first boss was my personal finance mentor. I never made a lot of money and have worked part time for the majority of my working years. He told me it takes forever to get that first 100k saved up but once you do it starts rolling. He was right. It took me 26 years to save 100k in my 401k(remember part time, don't make a lot of $$). My 2nd 100k only took 5 years to achieve. I'm on a roll...

Hard recommend here. Take a simple step that literally anybody can do and increase your awareness. Having baseline knowledge enables you to take command of future decisions whereas if you try to completely blow up your lifestyle and redo it without knowing exactly from where you start, it'll be very difficult to stack wins and build momentum.Try to take it a bit at a time. It's a big subject and can feel overwhelming at the start but when broken down, the individual steps are not complicated.

The best first step IMO is to track your expenses for a month or two and then put a budget together. Once you see where you are spending, you can identify areas for improvement and start growing the gap between what you spend and what you earn.

I was fortunate to listen to Warren Buffett advise to live/behave knowing that your financial assets will temporarily lose half their value, maybe several times during your life. He said that it'll allow you to sleep at night and keep you from making decisions you'll regret later.We were on track to hit 100K by 30 but unfortunately we turned 30 in 2001 and 2002 was worse than 2001. Whomp whomp. Our next 100K milestone we hit in 2007 then 2008 happened. Whomp whomp. That was a bad year, took several years to recuperate from that one. If you are young enough to have started after 2008 then I bet your milestones were much quicker. This year we lost 100K in one month and gained 100k the next month. lol So it does get faster in between milestones. Unfortunately, you lose a lot of money faster too.