Akck

DIS Veteran

- Joined

- Jul 10, 2019

I’m reviewing our statement and I’m attaching a screenshot of our 100 point contract for Riviera.

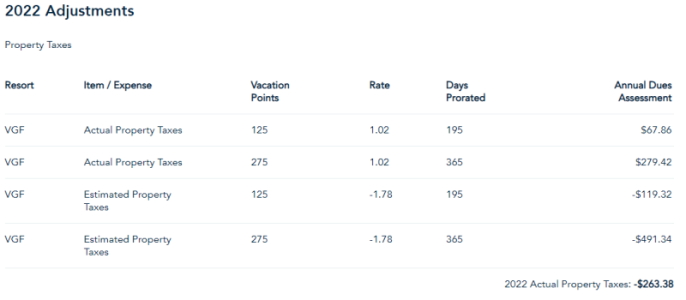

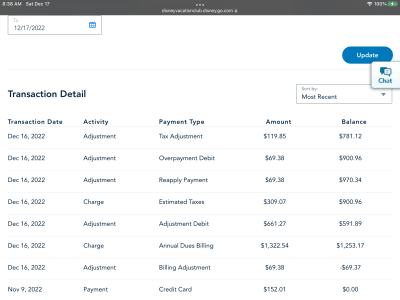

Annual dues for Riviera were posted as $8.5049/point. So, you’d think for this contract, I’d see $850.49 somewhere in the right hand column. If you ignore the tax adjustment in the top entry, my balance is $900.96, which equates to $9.0096/point. I looked at last year’s dues and couldn’t get the numbers to equate to the posted dues number, but I also had some adjustment, so I let it go. Does anyone have an explanation why the numbers don’t match the posted dues per point?

Annual dues for Riviera were posted as $8.5049/point. So, you’d think for this contract, I’d see $850.49 somewhere in the right hand column. If you ignore the tax adjustment in the top entry, my balance is $900.96, which equates to $9.0096/point. I looked at last year’s dues and couldn’t get the numbers to equate to the posted dues number, but I also had some adjustment, so I let it go. Does anyone have an explanation why the numbers don’t match the posted dues per point?