Hi all!

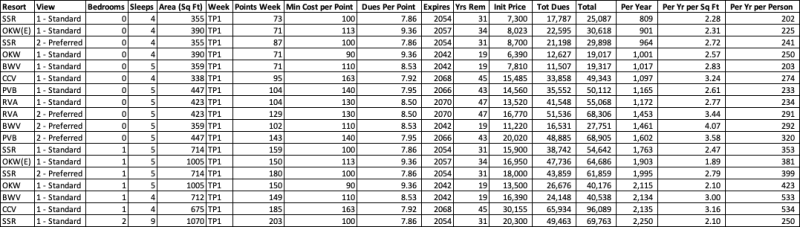

I was going through all the listings on DVC Resale market and my husband and I were considering purchasing Hilton Head, mainly only because we want more points. We are not necessarily worried about the Home Resort or the 7 month vs 11 month booking timeline. We already own at Copper Creek and have been discussing purchasing Old Key West since that's one of our favorite resorts, but saw some good listings for Hilton Head for the same amount of points at a cheaper cost. We would love some thoughts on this!

I was going through all the listings on DVC Resale market and my husband and I were considering purchasing Hilton Head, mainly only because we want more points. We are not necessarily worried about the Home Resort or the 7 month vs 11 month booking timeline. We already own at Copper Creek and have been discussing purchasing Old Key West since that's one of our favorite resorts, but saw some good listings for Hilton Head for the same amount of points at a cheaper cost. We would love some thoughts on this!