FreeDiningFanatic

DIS Veteran

- Joined

- Aug 18, 2015

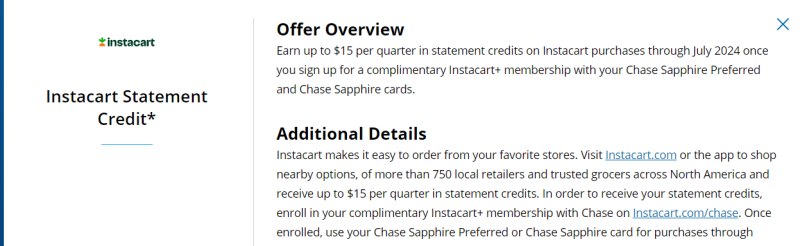

@disneylover81 You can actually earn $15 per quarter through July 2024, so that's $60 per year, once you've activated the free 6 month membership. There are some stores, like Aldi, where you can do pickup on orders over $35 for $1.99, once your free membership has expired.Have you activated the instacart membership? If so you will get $15 a quarter back. That will take you from $95 - $50 Hotel - $30 (2 Quarters of IC as membership is only 6 months for free) that takes you down to $15 plus Chase Offers as @Judique mentioned.

I have earned the full $60 since activating last year.