Last Nov, we downgraded DW's CIP to a CIU rather than close it to keep the CL available since it wouldn't transfer to her Hyatt Biz due to how they (incorrectly) set up the Hyatt Biz. The CIU kept the same exact card number. She was approved for the CIP in Aug '21. Is there any reason (e.g. same card number) she wouldn't be eligible for a new CIP SUB now?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

I love credit cards so much! v6.0 - 2023 (see first page for add'l details)

- Thread starter miztressuz

- Start date

havaneselover

Dreaming about a Disney cruise

- Joined

- Nov 9, 2009

No reason to not be eligible.Last Nov, we downgraded DW's CIP to a CIU rather than close it to keep the CL available since it wouldn't transfer to her Hyatt Biz due to how they (incorrectly) set up the Hyatt Biz. The CIU kept the same exact card number. She was approved for the CIP in Aug '21. Is there any reason (e.g. same card number) she wouldn't be eligible for a new CIP SUB now?

happysavermp

Earning My Ears

- Joined

- Oct 14, 2019

Player 2 instantly approved for CIC. Had 4 business cards before applying (CIC, CIU, CIP, and Southwest Business).

happysavermp

Earning My Ears

- Joined

- Oct 14, 2019

Continued post…Lowered all his business credit limits to $1000 except for the southwest which is $5,000. Then put spend on each of the cards around $100 to $200. Last approval before this one was 12/23 (Southwest business card).

Judique

Dis Veteran, Beach Lover at BWV, BCV, HHI, VB

- Joined

- Aug 1, 2003

I only have one Hilton FNC, that expires in August. I need to book it or forget it, but I could get 2 nights together on a decent redemption by using points with it for an additional night.I have to pay q1 taxes soon. I’m thinking of putting about $12k on my Hilton biz and I’ll finish spending for the fnc closer to the end of June.

Right now I have three fncs. One expires in June, one in October and one in December. I’m probably going to use the June one at home 2 suites in Georgia on my way home (this pains me). Maybe I’ll use the other two to visit my daughter in Atlanta for her birthday. I feel like I’m throwing these away but I’ll have two more soon that I’ll hopefully use next summer in Europe.

OR, I could just save the 130k points and get 4 nights back and forth to Florida in a decent Hampton Inn. At HI prices that's probably $700 in value.

I can use the fnc at the beach in summer and just move over to HI and Suites after 1 night or to Hyatt where I usually bunk at the beach. By now I've normally booked a few nights at the beach but I've been busy.

JackieT1182

Always planning our next Disney vacation

- Joined

- Oct 20, 2015

miztressuz

DIS Veteran

- Joined

- Feb 23, 2011

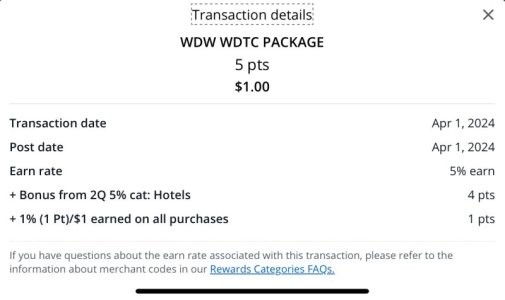

Happy to be surprised that this worked! Way to be the DP you wanted to see! Very helpful.For those wondering if Disney World packages (hotel + tickets) would count towards this quarter's Freedom 5% back, they do! I made a small charge just to see how it would code.

View attachment 847844

FYI @mds88 and @dawgs_do_disney , how did your test charges go?

LilSweetPeaPhoto

DIS Veteran

- Joined

- Feb 12, 2008

Okay all you people getting more Inks has me wondering if I need another Ink. I have 2 CICs and 2 CIUs. Would it be wise to close one? Anyone getting approved right now with multiples? I'm guessing I could close a CIU. My last CIU was 11/23. So not sure I'd get approved. I need a business card and nothing else is looking good to me. Well I could close my IHG Biz and churn it. It's been 2 years. I just need to wait a few days between closing and reapplying, right?

In the past, IHG won't extend. I had one that was expiring 4/2. But luckily my son and I used it last weekend to see UM play in the Frozen Four regionalHas anyone gotten a retention offer for an IHG Chase card recently? What was your offer? Can I just SM Chase about that?

Also, any idea who to contact to try and get a FNC certificate extended? Do I contact Chase or IHG? I tried chatting with IHG and didn't get anywhere.

Was the last Ink 12/22 as well. And did you have no CICs when you applied? I have 2 CICs and 2 CIUs w/ my last CIU being 11/23. I just wonder if I can get one.Instant approval P2, CIC. Closed two Inks yesterday, currently has 3 CIU cards, plus this one. Last CIU approved 12/22. I am kinda shocked!

georgina

DIS Veteran

- Joined

- Apr 21, 2003

Player 2 instantly approved for CIC. Had 4 business cards before applying (CIC, CIU, CIP, and Southwest Business).

Curious what credit limit he got with the new CIC? I don't reduce mine that low before applying because I usually want to transfer some to the new card. Currently sitting on a CIC with a $20,000 CL (from transferred CL) but a $6000 balance taking advantage of the 0% APR for 12 months.Continued post…Lowered all his business credit limits to $1000 except for the southwest which is $5,000. Then put spend on each of the cards around $100 to $200. Last approval before this one was 12/23 (Southwest business card).

becauseimnew

Planner-aholic

- Joined

- Jan 14, 2020

DP: Another instant Chase approval. I went for the CIP since we're traveling abroad soon.

I'm 3/24, with 3 Chase business cards currently open.

I'm 3/24, with 3 Chase business cards currently open.

*WDW*Groupie*

DIS Veteran

- Joined

- Oct 2, 2006

I'd close either a CIC or CIU that has been open for at least a year. I try to keep the biz cards to a minimum. I also lower the CLs to the minimum a few days before applying for a new card. I'd definitely try for a new UR-earning card, but I LOVE URs. As soon as I can meet the MSR I will be applying for another.Okay all you people getting more Inks has me wondering if I need another Ink. I have 2 CICs and 2 CIUs. Would it be wise to close one? Anyone getting approved right now with multiples? I'm guessing I could close a CIU. My last CIU was 11/23. So not sure I'd get approved. I need a business card and nothing else is looking good to me. Well I could close my IHG Biz and churn it. It's been 2 years. I just need to wait a few days between closing and reapplying, right?

In the past, IHG won't extend. I had one that was expiring 4/2. But luckily my son and I used it last weekend to see UM play in the Frozen Four regional

Was the last Ink 12/22 as well. And did you have no CICs when you applied? I have 2 CICs and 2 CIUs w/ my last CIU being 11/23. I just wonder if I can get one.

Did you see the new all inclusive Hyatt Vivid that opened in Mexico? Not on the beach (hotel offers a 10 minute shuttle to the beach), but looks quite nice.

happysavermp

Earning My Ears

- Joined

- Oct 14, 2019

The credit limit was only $5,000 on the new CIC card.Curious what credit limit he got with the new CIC? I don't reduce mine that low before applying because I usually want to transfer some to the new card. Currently sitting on a CIC with a $20,000 CL (from transferred CL) but a $6000 balance taking advantage of the 0% APR for 12 months.

elgerber

DIS Veteran

- Joined

- Feb 17, 2000

that was P2 also. But dd last week got $6000. but it was her first and only Ink.The credit limit was only $5,000 on the new CIC card.

LynnTH

DIS Veteran

- Joined

- Jun 26, 2003

I am so bummed. I was just about to PC one of my Marriott Cards to the Ritz Carlton card - mainly for the unlimited AU's and PP Pass Lounges with Restaurants. Now they took the Restaurants away - don't really see a need for this card. Glad I didn't pay the $450 annual fee before the change was made.

Maryrachel713

Mouseketeer

- Joined

- Jul 26, 2022

Honestly I don't know. I just feel like I keep hearing about Amex cards and wonder if we should get one.Which Amex are you looking at? There are many-some have high AFs, some don't. I have the Everyday which earns URs with no AF. I upgraded to the Preferred Everyday with a $95 AF when they offered a significant upgrade offer. Then after a year I downgraded back down until the next decent offer.

MRs can be transferred to many travel partners.

lsutigers03

DIS Veteran

- Joined

- Aug 14, 2019

Depending on your monthly spend there are a wide variety of AMEX cards you can get. I think the Blue Business Plus is a great place to start. It doesn't have an annual fee so it will keep your MR points alive if you cancel other cards. Also with certain links you can get a really nice sign up bonus. Recently I've seen 50k points with $8k spend in 3 months. Last year I was able to get 75k points with $15k spend in 12 months. With an additional 5k points with $1k spend on an employee card. I'm currently trying to get a 250k offer for the business platinum. So far I've only pulled 190k offers.Honestly I don't know. I just feel like I keep hearing about Amex cards and wonder if we should get one.

Maryrachel713

Mouseketeer

- Joined

- Jul 26, 2022

Monthly spend is at least 6k typically. It seems like Amex have higher AFs but that the rewards are supposed to be worth it. I wasn't sure if we should go for a Marriott card maybe (my husband is lifetime Gold) or get a nonbrnded card. Basically, I'm having FOMO over I'm not sure whatDepending on your monthly spend there are a wide variety of AMEX cards you can get. I think the Blue Business Plus is a great place to start. It doesn't have an annual fee so it will keep your MR points alive if you cancel other cards. Also with certain links you can get a really nice sign up bonus. Recently I've seen 50k points with $8k spend in 3 months. Last year I was able to get 75k points with $15k spend in 12 months. With an additional 5k points with $1k spend on an employee card. I'm currently trying to get a 250k offer for the business platinum. So far I've only pulled 190k offers.

There are Amex cards with no or low AFs. Only you can decide is Amex is right for you.Monthly spend is at least 6k typically. It seems like Amex have higher AFs but that the rewards are supposed to be worth it. I wasn't sure if we should go for a Marriott card maybe (my husband is lifetime Gold) or get a nonbrnded card. Basically, I'm having FOMO over I'm not sure what

Here is an article that lists all travel partners for MRs:

https://upgradedpoints.com/credit-cards/amex-membership-rewards-transfer-partners/

trying again

does anyone have any insight on how to make use of the $300 venture x travel credit if no trips coming up? that may make me decide to close the card. if we do, what should i do with the points/ different card? transfer? virgin has bonus now, no plans but could use them in 2025 for virgin cruise or trip possibly

2nd: if no good retention on amex plat, may have to close. same thing, where to put mr or what to do with them

i don't have any msr right now, putting spend on surpass for fnc so open to ideas

thanks so much

below 5/2, as is p2 and we each have 3 inks currently

does anyone have any insight on how to make use of the $300 venture x travel credit if no trips coming up? that may make me decide to close the card. if we do, what should i do with the points/ different card? transfer? virgin has bonus now, no plans but could use them in 2025 for virgin cruise or trip possibly

2nd: if no good retention on amex plat, may have to close. same thing, where to put mr or what to do with them

i don't have any msr right now, putting spend on surpass for fnc so open to ideas

thanks so much

below 5/2, as is p2 and we each have 3 inks currently

havaneselover

Dreaming about a Disney cruise

- Joined

- Nov 9, 2009

Long shot but I'm wondering if anyone can help with the logistics with canceling an Amex card because of death. I think my mom's plan is to get her own Platinum card. Previously my dad had one and she had a gold card. It's sort of confusing because they pool MRs and are under the same login but I think they are seperate accounts (meaning I don't think she's an AU on his Platinum card) and I think her Gold card is some kind of legacy product because it doesn't seem to have much in the way of benefits.

Dad paid his annual fee in January. Not sure if they give any sort of pro-rated refund due to death. And I'm not sure what happens to the MRs (only about 90k). Basically I want to preserve her MRs and get her a new card and ask if they will give a partial annual fee refund for his card. Any advice?

I'm trying to make her life as easy as possible. She's never dealt with the taxes before (but thankfully she is very sharp so she'll figure it out). I met their financial advisor and I think he'll take good care of her. We're going to the attorney tomorrow (the list of what they want is insane given that everything goes to her). I'm headed home this weekend but to say I don't want to go would be a massive understatement. I really wish it weren't so expensive to live down here.

Dad paid his annual fee in January. Not sure if they give any sort of pro-rated refund due to death. And I'm not sure what happens to the MRs (only about 90k). Basically I want to preserve her MRs and get her a new card and ask if they will give a partial annual fee refund for his card. Any advice?

I'm trying to make her life as easy as possible. She's never dealt with the taxes before (but thankfully she is very sharp so she'll figure it out). I met their financial advisor and I think he'll take good care of her. We're going to the attorney tomorrow (the list of what they want is insane given that everything goes to her). I'm headed home this weekend but to say I don't want to go would be a massive understatement. I really wish it weren't so expensive to live down here.

GET A DISNEY VACATION QUOTE

Dreams Unlimited Travel is committed to providing you with the very best vacation planning experience possible. Our Vacation Planners are experts and will share their honest advice to help you have a magical vacation.

Let us help you with your next Disney Vacation!

Dreams Unlimited Travel is committed to providing you with the very best vacation planning experience possible. Our Vacation Planners are experts and will share their honest advice to help you have a magical vacation.

Let us help you with your next Disney Vacation!

New DISboards Threads

- Replies

- 0

- Views

- 116

- Replies

- 0

- Views

- 63

- Replies

- 0

- Views

- 56

- Replies

- 4

- Views

- 143

- Replies

- 0

- Views

- 75