I don't like the resale restrictions, think the location is over rated, and think the MFs are high for what you get.

That being said you like the resort, are okay with

points charts, and will stay at Riv most years then get it.

Likely being one of the highest if not the highest WDW resorts for MFs means you better be staying there or what's the point.

Agree, agree, agree. It wasn't even on my list when I bought contract 1 AKL Direct & 2 PVB Resale

Just as an example, if you buy SSR instead at a easily obtainable $95/pt; you're looking at saving $20k-$30k AND have lower dues.

Counterpoint.

- I think first we have to ask if someone is buying direct or resale. They're very different economics. If direct, Riviera is $163/pt @ 200 pts and $157 @ 300 pts. Going direct, SSR and OKW are both still $165/pt. There are no WDW area DVCs that are cheaper per point than Riviera on a direct purchase.

- Combine the above statement with, there are no WDW DVCs that have a longer contract than Riviera. A plus for some, a negative for others.

- If going resale, this is much tougher. Sure, you're saved a bunch of money on your

car insurance by.. initial DVC purchase price, but they're not apples to apples. On any 2042 resort, it's already half life. Half price for half life? Nope. The cheapest of them all BRV & BWV are premium locations but sell for $90-$110, a 30-40% discount over Riveria. Of course you can also go with SSR/OKW/AKL that expires in 2054 or 2057 instead, it's only at quarter life (a little les 68-74% life) Quarter price for Quarter life? Most of the time. They'd have to sell for $110-$120 to be the equivalent of Riviera's offer prices. What about PVB/CCV/VGF? At $145ish, we're now looking at a $10-$20/pt difference. On 200 points, that's a $3600 difference. But that's still resale vs direct. Would you pay $3600 for blue card benefits? Let's say no. How about to stay at Riviera for the extra two years? Let's say no. What if you rented the instead then? They'd rent for $2900/year using today's prices. So let's say there's enough to cover the difference.

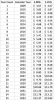

- But the dues! At $8.31, when Riviera launched only Hilton Head and Vero Beach had higher dues and we've all seen where their prices went. Since then, Aulani has joined them. AKL, OKW, BRV, BWV, and CCV are all within striking distance (less than $1) $1 is still a lot, so let's factor that in. On an annual basis on 200 points, it's $128, $94, $106, $188, $172 more respectively. How close is that? Well if you go to the trouble to pay your annual dues with a gift card so you can stack discounts, then you might care. If you don't, the roughly 6-11% premium isn't truly that important to you when all said and done.

- Let's also take into account also that historically, new resorts have minimal increases. CCV is enjoying that now. PVB is about 2%. VGF is having a blast too. If we take into account CAGR of annual dues, CCV, VGF, PVB, SSR are the only ones that will still be cheaper than RIV in 5 years.

The only thing I can't get over is the resale restrictions. But I have to admit, I've soften up a LOT over Riviera over the past year. All said and done, the financials aren't as terrible as they first seemed especially taking into account the direct perks if they're important to someone.

Even if they're not. If you buy CCV resale (Disclaimer: I'm in contract for CCV resale) then in 2067, you (or your children children) are stuck at CCV fighting the millions of cabin points for the one dozen studios. It might even start before that as bungalow and cabin points lose the option to spread out to 14 other resorts too...