I'm not sure what you are asking. Are you asking what is the price per point at CCV they would need to be so the average nightly room costs are the same between Riviera and CCV? If so CCV would need to sell for $300 points (after incentives) for it's nightly room cost to be equivalent to that of Riviera. CCV was cheap by today's standards of DVC direct pricing.

Assuming you had the cash today another vehicle to look at for opportunity cost (analogous to buying DVC) would be to buy an annuity, which pays out X per year for the length of the contract assuming a 3% rate of return. I'm also assuming the rate of return and rate of inflation on the MF is identical at 3%. I thought this was a fair compromise to show without muddying up the message I intended and avoids the whole is DVC cheaper than renting cash which wasn't the intention of this exercise. I will say because I assume MF inflation identical to my return rate this causes Vero and Hilton Head to jump to being cheaper by a lot, this is because their buy-in is significantly cheaper. This might not be fair since they exhibit a much higher historical inflation on the MF than the other resorts, and I don't recommend buying for at WDW anyways because if you have to stay there means you can't go to WDW or DLR same with Aulani, so they fall out of the "buy where you don't mind mentality".

Also the analysis is somewhat flawed because each of these were done with their own length of contract. So they ignore any reinvestment risk that might occur, this being the biggest reason I'm interested in Riviera in that I know what my cost is for 50 years and not worry about what I need to buy once the other contract expires. So someone could by BWV with its 23 years left but intending to use DVC for 50 years. Well this analysis ignores that component, it essentially assumes reinvestment risk (buying another DVC contract) is 0 and you will be able to buy essentially at the same price and point chart as the initial contract. So while the BWV buyer might be saving money for the first 23 years they could end up losing money if they re-buy into DVC another contract that lengthens their overall contract with DVC. I'm going to assume that is actually something a lot of the buyers on this board thought about, especially those that are younger not wanting to buy again in the future at a more expensive rate.

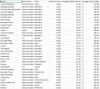

Deluxe Studios

View attachment 391312

Yeah agreed this shows the value of home resort priority, which is a bit different but another powerful thing that can't be forgotten. If you buy "cheap" points to stay in consistently stay in more expensive rooms point wise (because of availability issues at 7 months not because those are the rooms you want) you might not actually be saving any money in the long run as buying the home resort to get those cheaper points rooms.